Valuation Support

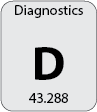

1. Adjustment of historical financial statements. This requires the recasting of past income statements and balance sheets to demonstrate the full potential of business earnings that the target company has.

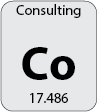

2. Helping you select appropriate business valuation methods (such as asset-based, market, or income approaches).

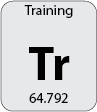

3. Conducting a detailed analysis of the value of the business using, among other things, analyzes of market comparative business sales, discounted cash flow analyses, analyses of multiples of discretionary earnings, and asset accumulation analyses.